idaho child tax credit 2021

CHILD TAX CREDIT CTC Rate Nonrefundable. The Idaho withholding allowances used in the Wage Bracket method are the number of children who qualify for the Idaho Child Tax credit.

Which States Offer A R D Tax Credit Incentive Leyton Usa

1 For taxable years beginning on or after January 1 2018 and before January 1 2026 there shall be allowed to a taxpayer a nonrefundable credit against the tax imposed by this chapter in the amount of two hundred five dollars 205 with respect to each qualifying child.

. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. Idaho Statutes are updated to the web July 1 following the legislative session. Any Idahoan who was a full-year resident in 2020 and 2021 and who also filed an Idaho individual income tax return or a Form 24 for those years is eligible for the rebate.

Child Tax Credit Update Portal. File With Confidence Today. Idaho residents must file if their gross income for 2021 is at least.

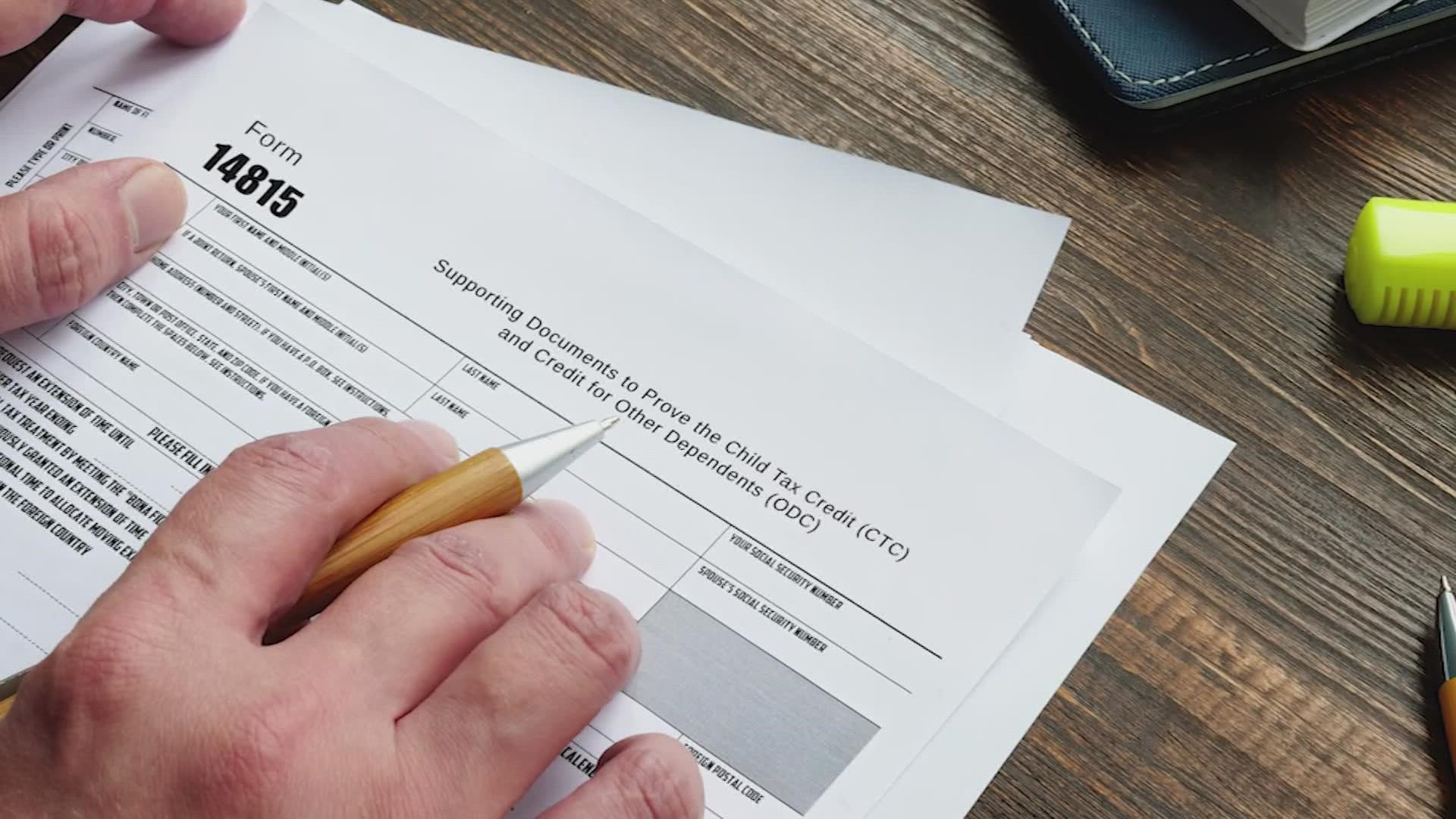

1-866-434-8278 toll free Mail. The employee enters this number on line 5 of the ID W-4. Form 40 is the Idaho income tax return for Idaho residents.

You dont need to adjust withholding back to the beginning of the year but you. 205 per qualifying child. Miscellaneous business income tax changes have been adopted see Conformity Page for details.

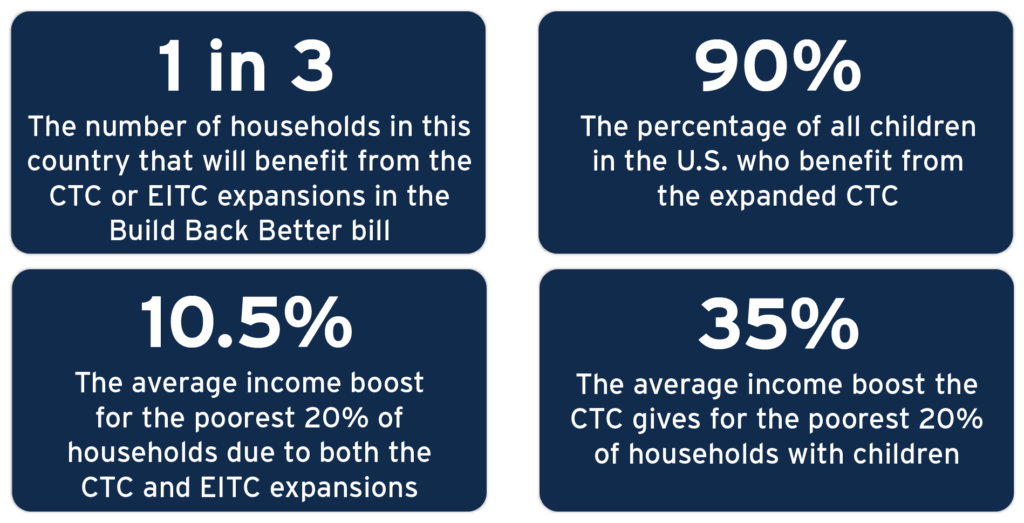

No Tax Knowledge Needed. E911 - Prepaid Wireless Fee. The tax credits included in the 19 trillion american rescue plan signed into law by president joe biden in march will provide families with up to 3600 per child over the course.

You can also refer to Letter 6419. Single age 65 or older. Philadelphia Internal Revenue Service 2970 Market St.

Then Apply by either. Idaho has a new nonrefundable Idaho child tax credit of 205 for each qualifying child. This includes the idaho child tax credit allowance table.

Eligible families can receive a total of up to 3600 for each child under 6 and up to 3000 for each one age 6 to 17 for 2021. Child Support Services enhances the well-being of children promotes positive parental involvement and improves the self-sufficiency of families. Find the correct chart for your payroll frequency and the employees withholding status.

To complete your 2021 tax return use the information in your online account. The individual income tax rate has been reduced by 0475. Do not use the Child Tax Credit Update Portal for tax filing information.

3 21720 86880. Ad The new advance Child Tax Credit is based on your previously filed tax return. You can still access the child tax credit which for the 2021 tax year is worth up to 3600 per.

House Bill 232 Effective July 1 2021. You dont need to adjust withholding back to the beginning of the year but please use the revised tables going forward. If applying for APTC and applying for or receiving other benefits Download and complete an application.

You are not entitled to advance Child Tax Credit payments. Married couples filing jointly with an adjusted gross income AGI of 150000 or less in 2021 heads of household with an AGI of 112500 or less and single filers with an AGI of 75000 or less are all eligible for the full credit. The corporate income tax rate has been.

Weve updated the income tax withholding tables for 2021 due to a law change that lowered the tax rates and decreased the tax brackets from seven to five. Child tax credit allowances are. Electricty Kilowatt Hour Tax.

The expanded 2021 child tax credit is available for people who meet certain income requirements. Tax Year 2021 Annual Income limits. Nonresidents and part-year residents arent eligible.

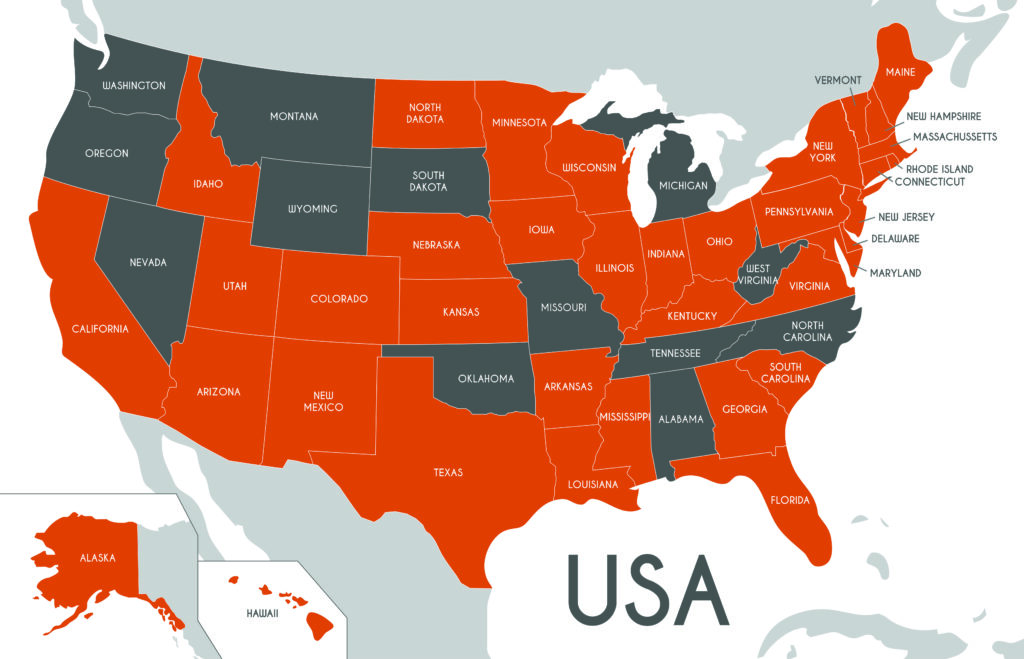

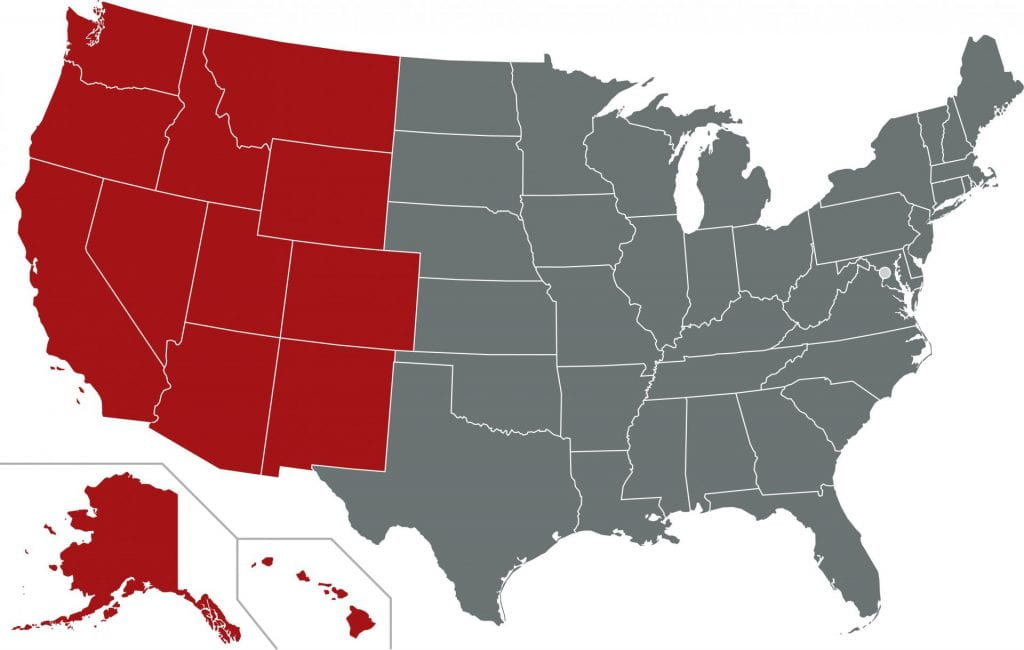

HOUSEHOLD SIZE MINIMUM INCOME MAXIMUM INCOME. This includes updating the Idaho Child Tax Credit Allowance Table to reflect the lower tax rates. Idaho Illinois Pennsylvania Rhode Island.

This tool can be used to review your records for advance payments of the 2021 Child Tax Credit. Business income tax return changes. Idaho Child Care Program.

You may be eligible to claim the Child Tax Credit when you file your 2021 tax return but may not be able to claim all 3000 or 3600 per qualifying child because your main home will not be in the United States for more than half of 2021. Instructions are in a separate file. The overall package received criticism for not doing enough to help lower-income families in the state and.

Answer Simple Questions About Your Life And We Do The Rest. Collapse this accordion item. Fuels Taxes and Fees.

This includes the Idaho Child Tax Credit Allowance table. These updated FAQs were released to the public in Fact Sheet 2022-17 PDF March 8 2022. Welcome to MyChildSupport Idaho Child Support Services customer portal.

The top rate for individuals is now 6925. Expand this accordion item. File a free federal return now to claim your child tax credit.

Apply by mail email or fax. Single under age 65. 2 17240 68960.

Weve updated the income tax withholding tables for 2021. Check out the new withholding tables online Employers and payroll providers. Employers and payroll providers.

As a result you were eligible to receive advance Child Tax Credit payments for your qualifying child. Self Reliance Programs PO Box 83720 Boise ID 83720-0026. Married filing separately any age.

The amount of Idaho income tax to withhold is. More than and Less than 1 12550 000 12550 14138 1000 of the amount over 12550 14138 17313 16 plus 3100 of the amount over 14138 17313 18901 114 plus 4500 of the amount over 17313 18901 20489 185 plus 5500 of the amount over 18901. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic O.

If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying child for purposes of the 2021 Child Tax Credit. That depends on your household income and family size. On March 12 2018 Governor Butch Otter signed legislation to enact a state-level Child Tax Credit worth 130 per child as part of a larger income tax cut package.

Idaho House Passes 600 Million Income Tax Cut And Tax Rebate Bill Idaho Capital Sun

Idaho House Passes 600 Million Income Tax Cut And Tax Rebate Bill Idaho Capital Sun

Next Child Tax Credit Payment To Hit Bank Accounts Next Week East Idaho News

Final Deadline For 2021 Health Insurance Is April 30

The Problem With Returning To A 2 000 Non Refundable Child Tax Credit Itep

No Child Tax Credit Deal In Sight As Monthly Benefits Lapse Roll Call

No Child Tax Credit Deal In Sight As Monthly Benefits Lapse Roll Call

No Child Tax Credit Deal In Sight As Monthly Benefits Lapse Roll Call

How To Get The Child Tax Credit If You Have A Baby In 2021 Money

Tax Credits In Build Back Better Support Millions Of Families Itep

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Why Is There No Child Tax Credit Check This Month Ktvb Com

State By State How Are Families In The U S Using Their Child Tax Credit Payments Social Policy Institute Washington University In St Louis

The Federal Geothermal Tax Credit Your Questions Answered

Child Tax Credit Payouts Biggest In Gop States Despite No Republicans Voting For Bill